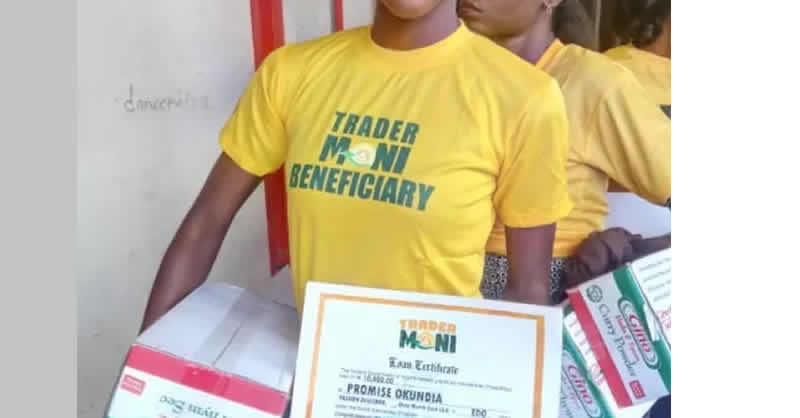

FG spending on Tradermoni, others hits N36.3bn

Economic experts on Thursday weighed the impact of the funds disbursed to poor Nigerians through the Government Enterprise and Empowerment Programme, as latest data showed that a total of N36.3bn had so far been spent under the scheme.

GEEP is one of the clusters of the National Social Investment Programme handled by the Federal Ministry of Humanitarian Affairs, Disaster Management and Social Development.

Other arms of the NSIP include the N-Power programme, National Home Grown School Feeding Programme and the Conditional Cash Transfer scheme.

Data obtained by our correspondent from the NSIP Information Brochure indicated that 2.3 million had received between N50,000 and N300,000 under the government empowerment programme.

The government stated that it provided loans to beneficiaries to grow their businesses through schemes such as TraderMoni, Market Moni and FarmerMoni.

It said, “The GEEP programme in the last four years has provided incremental loans of between N10,000 and N300,000 to about 2.3 million beneficiaries who are mainly traders, artisans, enterprising youth, agricultura] workers, and other micro-services providers.

“A total of 2,678 clusters have been engaged across the farms, trade groups and markets along with a total of 4,988,926 enumerated and verified applicants, from which the programme was able to successfully disburse funds to 2.3 million beneficiaries between 2016 and 2019.”

On the total loan, the government said, “The beneficiaries’ cash disbursed so far sums up of N36.3bn, with 2.3 million beneficiaries and 2.7 million candidates on the waiting list.”

Commenting on the development, economic experts at the Centre for the Promotion of Private Enterprise stated that the impact of the scheme had not been felt as expected in economically.

The centre’s Chief Executive Officer, Dr. Muda Yusuf, told our correspondent that the programme should be interrogated, as he expressed doubt if the beneficiaries were paying pack the loans.

Yusuf, a former Director-General of the Lagos Chamber of Commerce and Industry, said, “First of all, let’s interrogate the sustainability of this programme. This fund is supposed to be a loan, now how much of it has come back? What is the default rate?

“What happens with many of these things is that they go around, gather people and give them the money. This fund is supposed to be revolving and so how much of it has come back? What is the default rate? My guess is that the default rate will be extremely high. So the first thing is to tackle the issue of sustainability.

“Also, the agencies should be able to give us the metrics for measurement of impact. They gave out funds, what has been the impact? You don’t measure impact by how much you have disbursed. The CBN does a lot of that.”

Copyright PUNCH.